Celsius Land – March Update 2021

Arabian Court, Champion Lakes Update

Celsius Land is continuing to work on the town planning for the 64 lot Arabian Court development in Champion Lakes. In March 2021, the City of Armadale asked Celsius to consult with two other developers who have purchased land in the area prior to finalising the boundary of the Local Structure Plan area. Celsius has now had these discussions and expects to receive in principle agreement from these developers in the coming weeks. Once agreement has been reached a revised proposal will be submitted to the City of Armadale, following which the structure planning process can commence. Whilst this is taking a little longer than anticipated it is important to get the Structure Plan area correct before commencing planning works in earnest.

The Land Market

With March 2021 being the 12-month anniversary of WA’s first lockdown, it is interesting to look back on the strength and resilience of the WA land market over the last 12 months.

In January / February 2020 the market was showing early signs of improvement, with improved sales compared to 2019. From mid-March to the end of April 2020 sales were at a low of approximately 30 lots per week, not surprising given the uncertainty and restrictions in place. By May 2020 this had improved to 90 sales per week, without any government stimulus introduced to that point. In June 2020, the State and Federal Government announced building stimulus of up to $45,000 per home with the land market quickly ballooning to a sales rate of 350 sales per week in June 2020 as buyers rushed to purchase titled land. Sales rates since then have steadily declined to a more stable rate of 100 sales per week in October 2020, where they have remained since this time. It has certainly been a roller coaster ride!

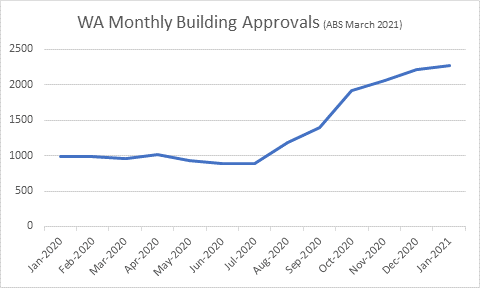

April 2021 will be the first month the land market has operated without any state or federal stimulus since June 2020, although it has been difficult to obtain building grants in recent months due to capacity constraints. Whilst this stimulus has been removed from the market, we have not yet seen the impact of this stimulus on the WA economy. The graph below shows building approvals in Western Australia. As of January 2021, these approvals had not yet peaked, having more than doubled from 890 approvals in July 2020 to 2275 approvals in January 2021. This will provide significant stimulus to the construction sector which employs 9.8% of Western Australia’s workforce over the next 18 months.

Additionally, whilst we expected civil contractors to have some additional capacity in 2021, this has not been the case with many contractors declining to tender in recent weeks due to capacity constraints, resulting in construction rates having already increased in 2021. There is no doubt both the home building and civil construction industries will take time to adjust from their contraction from 2015 to 2019 with a much smaller workforce currently in place.

We have not yet seen any significant increases in greenfield land pricing despite the strong market conditions and increased costs, although there has been a reduction in incentives and the ability for buyers to negotiate since May 2020. Over the medium to long term, we expect that the price of residential lots will continue to be closely correlated to local established housing prices, which are continuing to show steady signs of improvement across WA in recent months.

If any of the above is of interest to you please contact Brenton on 0467 006 122 for further information.

Regards,