Bank branch closure drive record broker demand

If you’ve noticed fewer bank branches in your neighbourhood lately, you’re not imagining it – and you’re certainly not alone in looking elsewhere for help with your finances.

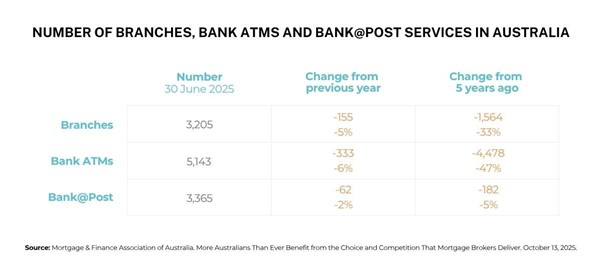

The number of bank branches across Australia has fallen sharply, down 5% over the past year and a staggering 33% over the past five years, according to Canstar analysis of official banking data.

As banks move online, many borrowers are turning to mortgage brokers for personalised guidance that big institutions can no longer provide in person. With most transactions now handled digitally – from opening accounts to applying for loans – fewer people are visiting branches at all. Instead, borrowers are seeking the human support they once got over the counter from brokers who can meet face-to-face or online, explain complex lending options, and guide them through the process from start to finish.

It’s little wonder brokers are now responsible for a record 77.6% of all new home loans, up from 67.2% just two years ago, according to Cotality research. Unlike banks, brokers can compare dozens of lenders to help you find a loan that genuinely suits your needs.

Importantly, as part of the Best Interests Duty, brokers are legally required to act in your best interests – something banks don’t have to do. So as the traditional branch network continues to shrink, more Australians are choosing brokers for expert guidance, wider choice and a service that puts them first.

Please reach out if you’re thinking about buying a property or refinancing an existing loan, so I can compare the market for you and manage your application.