Consumer Confidence in Perth Property Market despite 12 interest rate rises since May 2022

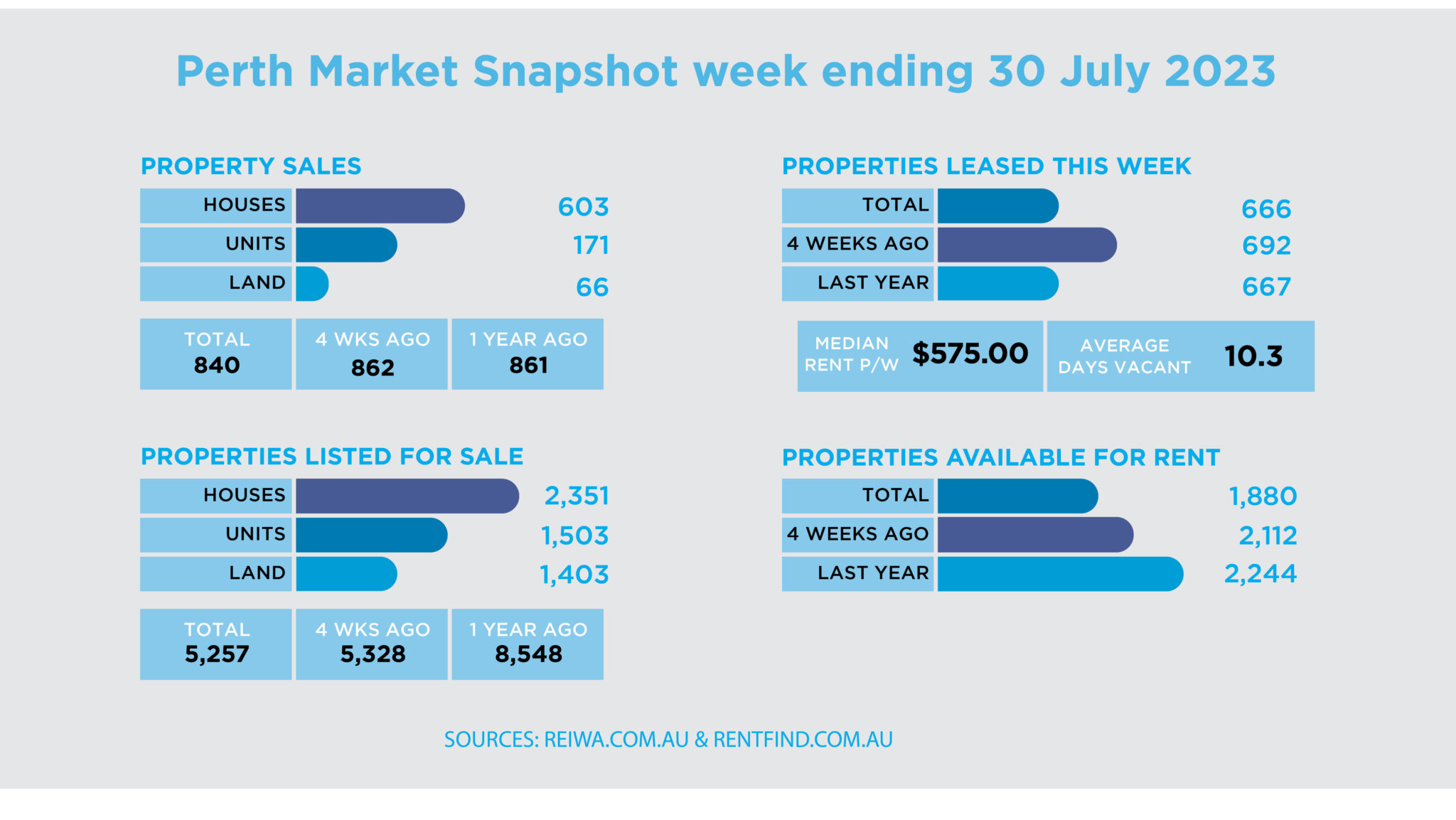

Despite multiple interest rate rises the median time to sell a house in Perth in June 2023 was just 10 days according to the Real Estate Institute of WA (REIWA). Additionally the rental vacancy rate remains below 1%, house prices are rising and there are just 2,442 houses and 1,486 units currently listed for sale. With 733 sales of houses and units in the last week alone it is safe to say we are in very short supply of available properties to buy. In Perth’s rental market, REIWA members reported just 1,985 properties for rent in Perth and there were 611 properties leased in the last week alone.

Over the past 12 months the properties available for sale have reduced by 38.5% and when comparing this to a balanced market of approximately 12,500 properties we are now 57.9% below a balanced supply level. In January 2023 I wrote an article pondering whether the strong property fundamentals would finally shift consumer confidence or whether the ongoing interest rate rises would keep consumers squarely on the side lines. I think the statistics in the paragraph above put the argument to bed and it is now widely being reported in the media across Australia, that Perth is the best performing property market across the capital cities of Australia.

Tim Lawless, Executive Research Director Core Logic Asia Pacific published a research article last week titled East or West, Australia’s Best Place to Invest and you can access the full article here.

“What really strikes me is that Western Australia, or Perth as the capital city, has one of the lowest portions of investment activity but the highest gross rental yields among the state capitals, at 4.9% and arguably some of the best prospects for capital gains.

Additionally, the entry point to the market is more achievable, with Perth home values recording the lowest median of the state capitals and prices are proving to be pretty resilient through the rate hiking cycle so far, in fact Perth is the only capital city where housing values have recovered to a new record high.

To me, the fundamentals suggest it is a location that presents one of the best investment opportunities around the country. And yet we’re not seeing investors very active in that marketplace.”

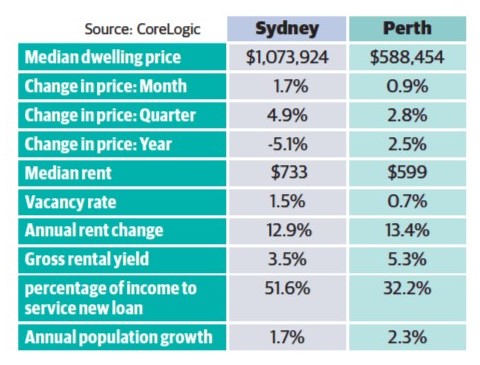

The above graphic by CoreLogic highlights the huge discrepancy between the median house prices of Sydney and Perth. It seems almost far fetched that in late 2007 the median house prices of Sydney and Perth were both just over $500k with Sydney just $15k ahead of Perth. Yet four years earlier Sydney had a median house price of $520k and Perth $252k! Now I’m not suggesting Perth is on the verge of racing to a median house price of over $1million over the next four years however history does suggest the gap will narrow and given the lack of supply and increasing population from strong interstate and international migration, prices in Perth are likely to continue to rise. By how much is anyone’s guess and will very much depend on our ability to create additional supply in a timely manner. Some ongoing price escalation is a good thing as it will assist the industry to create additional supply following very substantial increases in construction costs rendering many infill projects unviable. However unlocking this supply ahead of pricing getting out of control must be a key priority of all stakeholders and therefore taking a deep dive into how we might be able to reduce the cost side is imperative too.

At Celsius we have just 50 dwellings currently under construction and over 400 in planning and we are doing everything we can to expediate approvals to move these developments closer to fruition. We will also be releasing our 86 lot land subdivision in Piara Waters this October with titles expected around April 2024. We are seeing strong demand for this product with a high number of registrations of interest received in the lead up to the release.

In the meantime there remains some very good buying in the Perth property market and I’d encourage anyone contemplating getting into the market to do the necessary research to be able to make an informed decision and then take action.

As always if you have any queries we can assist with, please don’t hesitate to reach out at any time.

All the very best,