Perth in Perspective

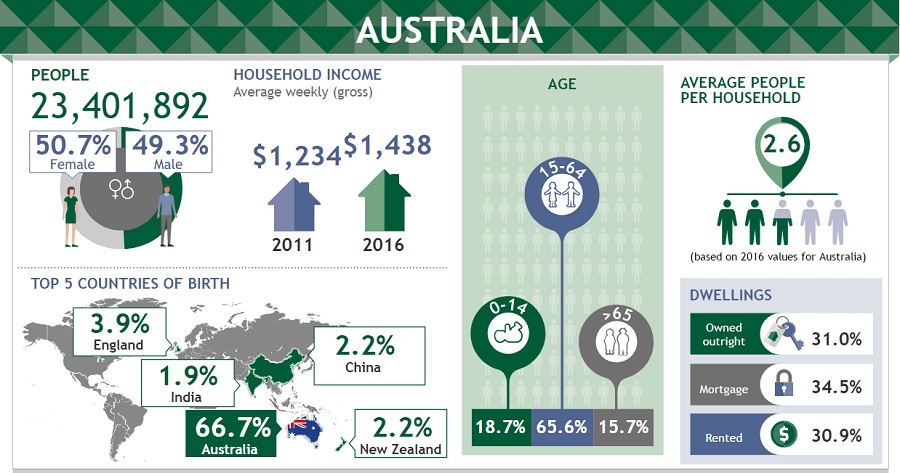

This week saw the release of the 2016 Census results and I enjoyed an ABC article which summarised WA’s results as follows:

“We’re younger, richer, and have slightly more children than your average Aussie. But West Australians also pay more rent, own more cars and have a higher level of mortgage stress than people in many other states and capital cities. The latest Australian Bureau of Statistics’ breakdown has revealed something we probably already intrinsically knew — sandgropers are just a little bit different from our eastern states’ cousins.”

Well aint that the truth when it comes to the property market… However let’s not lose sight of the fact that there was once a time (2003 – 2007) pre mining boom, when Perth led the nation as the East Coast property market ground to a halt. Our time will come again and those that are patient and those that move against the tide will be the most successful.

Tomorrow marks the end of the financial year and for many WA businesses and individuals it’s been a tough one. At Celsius we have been fortunate to have reaped the benefits of 4 years hard work culminating in strong growth across all divisions. Don’t get me wrong it hasn’t been easy, but who says being a successful small business is meant to be easy!

Despite the tough economic times 2017 has been considerably better than all of 2016 and even most of 2015. Finally Sellers are bringing their prices down and Buyers are increasing their budgets and now more often than not, well located, well priced properties are selling in a relatively short timeframe. Note the latest REIWA figures included in this month’s newsletter show sales activity up greater than 12% on 4 weeks ago and on 12 months ago.

The rental market remains challenging with a high vacancy rate leading to record low rents. The stock that has been created must be absorbed into the market and with population growth (yes we are still growing) at levels not seen for many years, this is going to take some time. Ensuring properties are priced right and well presented and your Property Management company has a “drop almost anything” approach to dealing with prospective tenants is mandatory. This will ensure your vacancy rate continues to outperform the Perth average.

So despite the reported doom and gloom we still see the following significant opportunities depending on your circumstances….

- If you are a tenant saving to buy your first home – rent is cheap allowing you to save quicker and prices are not surging ahead whilst you save.

- If you are a home owner looking to upgrade or even down size – so long as you move within the same market there is little pain to be had and a whole lot of choice when it comes to selecting your new home.

- If you are an Investor – choosing wisely will ensure you still attract good tenants and record low interest rates make the low rental yields more than manageable for most.

Whilst we are not prepared to call the bottom of the Perth property market just yet, many commentators are and we look forward to reporting in the near future, concrete evidence to show the bottom has come and gone.

With so much opportunity and uncertainty around we welcome the opportunity to discuss with you any queries you may have and we look forward to working with you through the next and many more financial years.

All the very best

Richard