Property investors enjoying strong rental demand

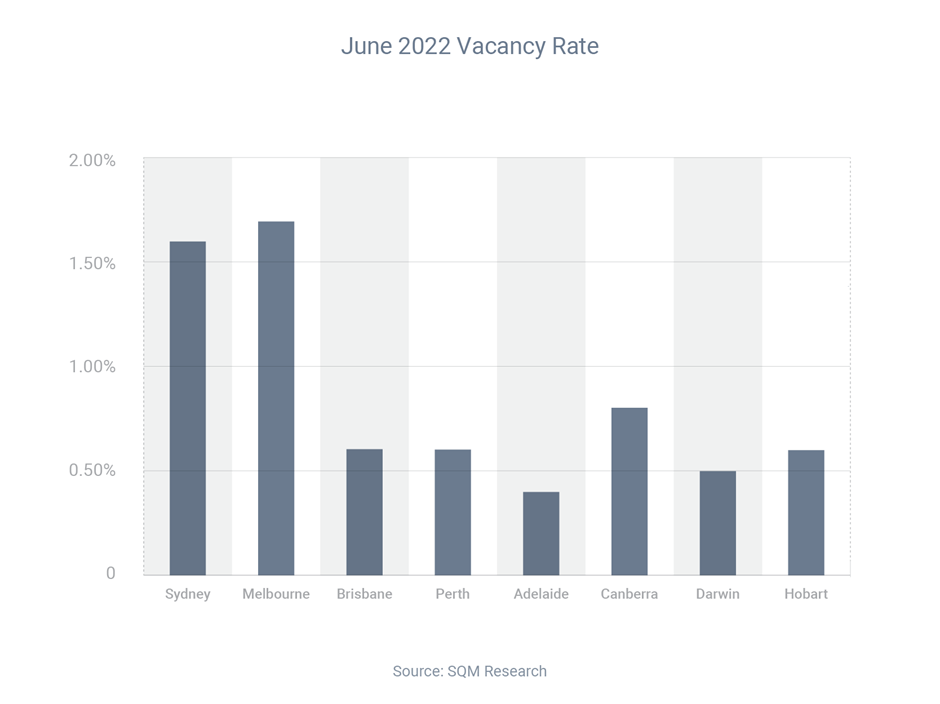

Australia recorded a national vacancy rate of just 1.0% in June, according to SQM Research, which means the rental market is strongly favouring property investors.

Over the past 12 months, the vacancy rate has fallen from 1.7% to 1.0%. As a result, there is now only one vacancy for every 100 rental properties.

Extraordinarily, the vacancy rate is even lower in six of the eight capital cities.

When the vacancy rate is so low, it’s easy for property investors to find quality tenants for their property, because demand is so high.

In that kind of landlord’s market, rents tend to rise, because tenants are willing to pay more money to ensure they have somewhere to live.

If you’d like to buy an investment property, I can help you secure finance. While prices are softening in some markets, that can actually be a blessing in disguise, because it means you’ll face less buyer competition.

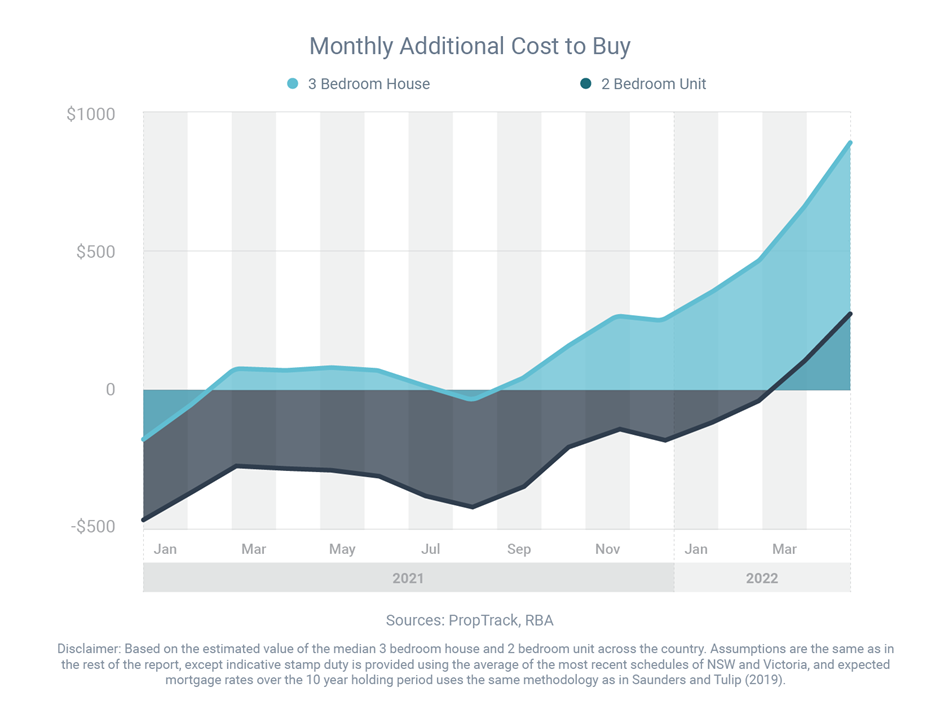

If you’re wondering whether it’s cheaper to buy or rent, a new report has answered that question.

It’s currently cheaper to buy 27% of homes in Australia, according to PropTrack, although the numbers vary significantly from state to state:

- Northern Territory = 98% of homes are cheaper to buy than rent

- Western Australia = 62%

- Queensland = 51%

- Tasmania = 41%

- South Australia = 34%

- ACT = 29%

- New South Wales = 9%

- Victoria = 7%

PropTrack’s analysis relied on a range of assumptions, including that buyers would pay stamp duty, put up a 20% deposit, pay a mortgage rate of 4.62%, experience capital growth of 3% per annum and hold the property for 10 years.

While PropTrack found 27% of the overall housing stock is cheaper to buy than rent, buying turned out to be the cheaper option for 31.2% of three-bedroom houses and 52.6% of two-bedroom units.

Wondering whether renting or buying would be cheaper for your personal scenario? If so, reach out and I’ll be happy to crunch the numbers for you.

Interest rates may be rising, but Reserve Bank deputy governor Michele Bullock is confident most borrowers will be able to cope.

One reason for her confidence is that “household balance sheets are in very good shape”, because the average household is ahead on their mortgage and has considerable equity in their home.

Ms Bullock also noted lending standards have increased in recent years, to qualify for loans, borrowers had to prove they could pay “significantly higher” interest rates.

That said, with interest rates almost certain to rise further, it would be wise for households to plan ahead. Here are some ideas:

- Pretend your interest rate is 1.50 percentage points higher – pay the difference into an offset account, a redraw facility or a special savings account, so you’re prepared if rates do reach that level.

- Reduce discretionary spending – holiday domestically rather than internationally, go out less, cook more meals, switch from Ubers to public transport, buy less ‘stuff’.

- Increase your income – ask for a raise, switch to a higher-paying job, do more hours, start a side hustle, rent out a spare room in your home.

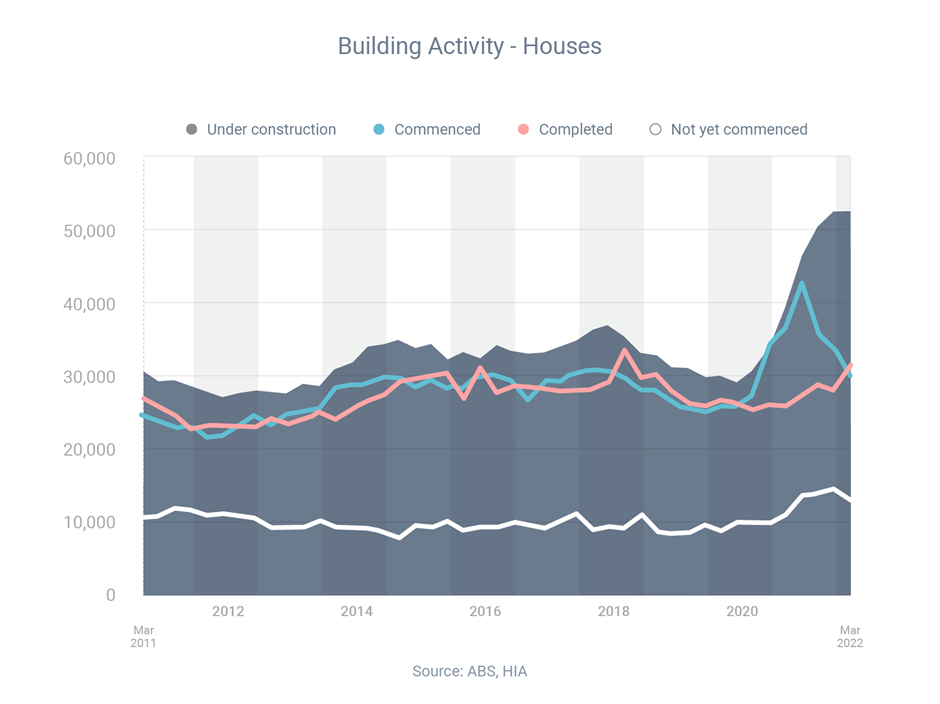

Despite a few negative headlines about some construction companies experiencing financial difficulties, Australia is actually in the midst of a home building boom.

A record 143,037 new house builds were started in the year to March, according to the most recent data from the Australian Bureau of Statistics.

Housing Industry Association economist Tom Devitt said the volume of detached houses under construction is almost 80% above pre-pandemic levels.

“This was driven by the combination of the HomeBuilder grant [which ran from June 2020 to April 2021] and record low interest rates,” he said.

“Even after the end of the grant, all the extra time Australians were spending at home, either working or locked down, resulted in a pandemic trend towards space and amenity.

“This kept demand for new housing and renovations elevated. Other indicators, such as building approvals, finance approvals and new home sales, continue to show a strong volume of work entering the pipeline.”

Mr Devitt said that with demand high, and supply constraints slowing down the pace of work, Australian home builders will be busy for the rest of this year and into 2023.

I hope you enjoyed this month’s news. If you need a new loan, want to refinance or just need some expert advice, get in touch and I’ll be happy to help.

Warm regards,