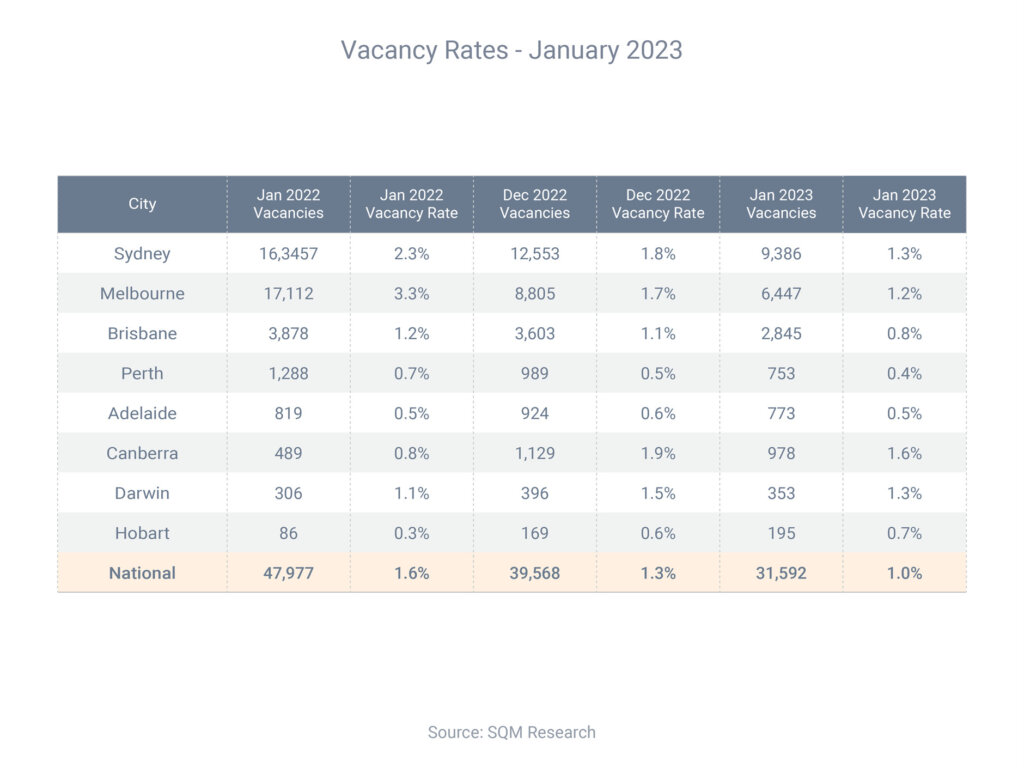

Rental vacancies fall by a staggering 34.2%

The rental market has turned decisively in favour of property investors, with the number of vacant rental properties plummeting by one-third over a 12-month period.

Between January of 2022 and 2023, the number of rental vacancies across Australia fell from 47,977 to 31,592, a reduction of 34.2%, according to SQM Research.

At the same time, the vacancy rate – which measures the share of untenanted rental properties – fell from an already low 1.6% to just 1.0%.

Vacancy rates differ from city to city, but are low throughout the country, ranging from 0.4% in Perth to 1.6% in Canberra.

SQM Research managing director Louis Christopher said low vacancy rates were contributing to a “surge in rents”, which in turn was pushing up rental yields.

“I believe would-be investors will be attracted to higher rental yields in later 2023, provided the cash rate peaks at below 4% [it’s currently 3.35%],” he said.

Get in touch if you would like an investment loan.

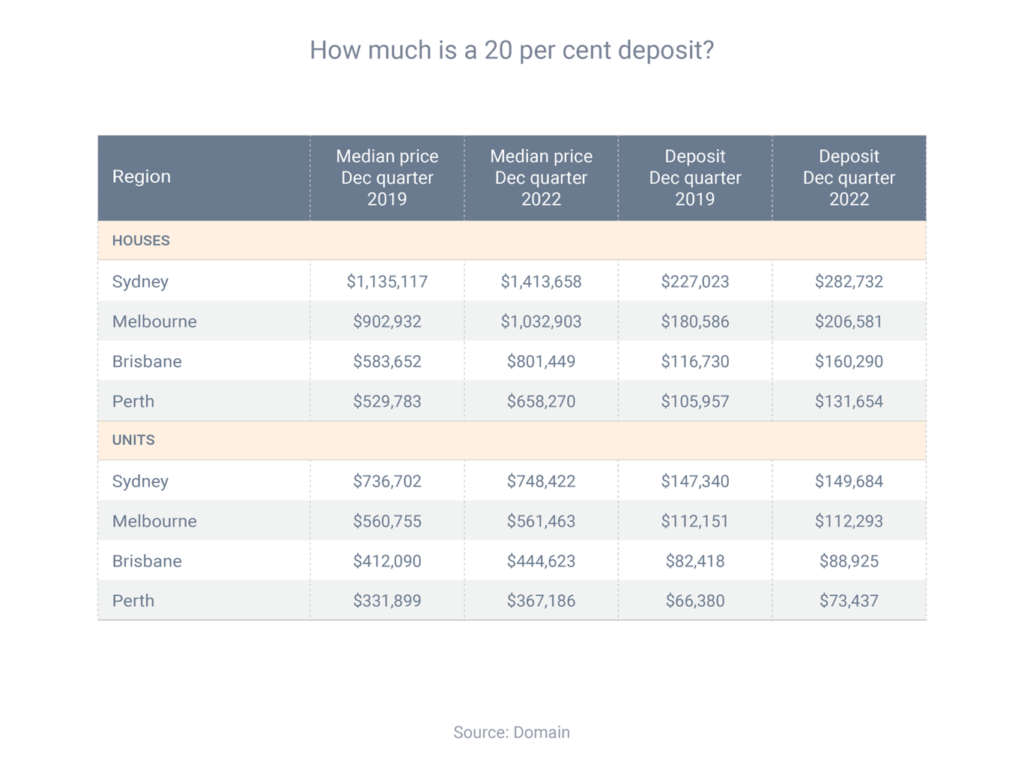

Despite the recent housing downturn, property prices are higher in most parts of the country than before the pandemic. As a result, deposit requirements are higher.

Domain compared property prices in the December quarters of 2019 and 2022, and found that buyers needed tens of thousands of dollars more today if they wanted to buy a house and put down a 20% deposit.

The increase in 20% house deposits for our four biggest cities was:

- Sydney $55,709 increase between 2019 and 2022

- Melbourne $25,995

- Brisbane $43,560

- Perth $25,697

While the deposit barrier is high, it’s not insurmountable.

As an expert mortgage broker, I can potentially help you enter the market with a low-deposit loan. Generally, if your deposit is lower than 20%, you will need to pay lender’s mortgage insurance (which can be added to your loan). While it’s never nice to pay an added fee, it can be money well spent if it lets you buy a property several years ahead of schedule. But there are also low deposit schemes offered by the federal government and Keystart loans also an option without paying any lender’s mortgage insurance.

Contact me to see what options and incentives are available to you.

Warm Regards,