How the WA property market differs from the rest of Australia

Well haven’t we seen some mixed messages through the start of 2019!

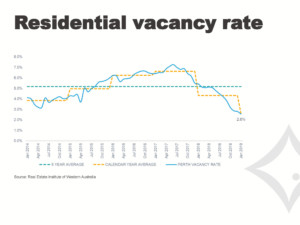

The Perth rental vacancy rate now sits at just 2.6% whilst the number of listings available for sale has continued to rise. The mining sector is recording strong growth and how about the numbers being generated by our farmers, and yet, our unemployment rate rose….

Tim Treadgold wrote a great article for Business News titled “State shaking off sick-man status as fertile seeds sown” which is well worth a read if you have a spare 2 minutes…. Full article here – please note you will need a Business News subscription to access the article.

Does this sound familiar to you? When was the last time WA performed in line with the rest of Australia? I reckon we have been singing our own positive or negative tune for the best part of the last 2 decades.

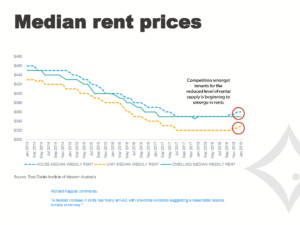

So should the consistent drop in the Perth vacancy rate over the past 2 years form a peak of 7.2% to just 2.6% today suggest green shoots are appearing in the residential property sector too? Well I can report that 65% of properties leased in the past 2 weeks at Celsius have achieved a rent higher than they were previously receiving. In some cases the increase is $50 per week or in excess of 10%, still a long way from boom times but the first increase in rents since 2013.

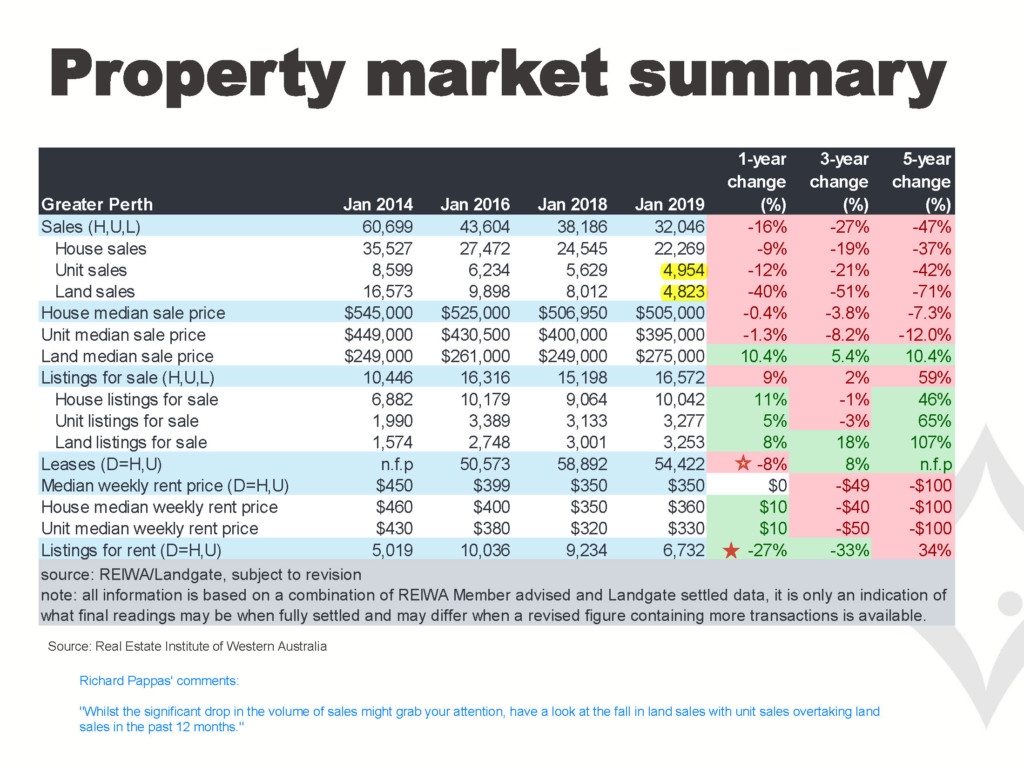

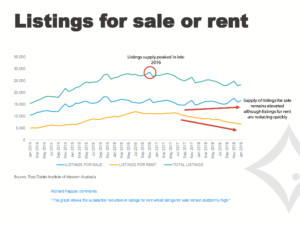

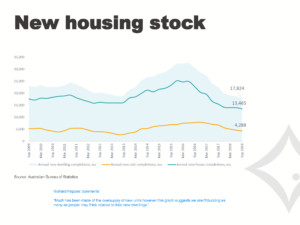

REIWA research provided us with some interesting analysis this week which provide some compelling reading and I have included a few of those slides below:

I think the jury is still out on exactly what all of the above means in terms of the immediate state of the Perth property market but being a glass half full person, I’d like to suggest there is a lot more positive data than negative and perhaps, just perhaps we are finally on the mend.

As always we are here to assist you with all your property related queries so please feel free to give me a ring on 0411 144 230 anytime to see if I may be able to assist you.

All the very best,

Read our latest monthly newsletter here