Will tenants start buying when they realise it is cheaper to own than rent?

The answer is probably yes, and no…

With a vacancy rate now sitting well below 3% and some pressure on rents appearing, I wonder at what point do tenants choose buying over renting.

We know that 30% of the population rent for a myriad of reasons. Some are saving a deposit, some have been transferred for work or are planning to relocate with work, some don’t feel secure in their job, some are worried about losing money if prices drop and some just don’t believe in property and are hopefully investing in super / shares as opposed to cars, boats and holidays!

Some buy an investment property and still chose to rent… perhaps an article for another time.

According to media reports this week, millennials (as a generalisation) are less interested in buying and paying off a house and more inclined to live for today. I’m not so sure this is true. Perhaps they are more interested in living for today because in Perth particularly, the housing market has performed poorly and for a number of years, it has been really affordable to rent. Perhaps in Sydney however, people are renting because they have to, with serious affordability issues making it very hard to buy a home in the area you want to live in.

I still believe the great Australian dream of buying and paying off your own home remains alive and well. Whilst I am not quite there yet, I can’t wait for that moment when I collect our dream family home’s title deeds from the bank. Never to be a tenant or personal mortgage holder again… I mean how good must it feel to know you can live rent and mortgage free for the rest of your life?

But back to the original question, at what point do tenants decide to go out and buy?

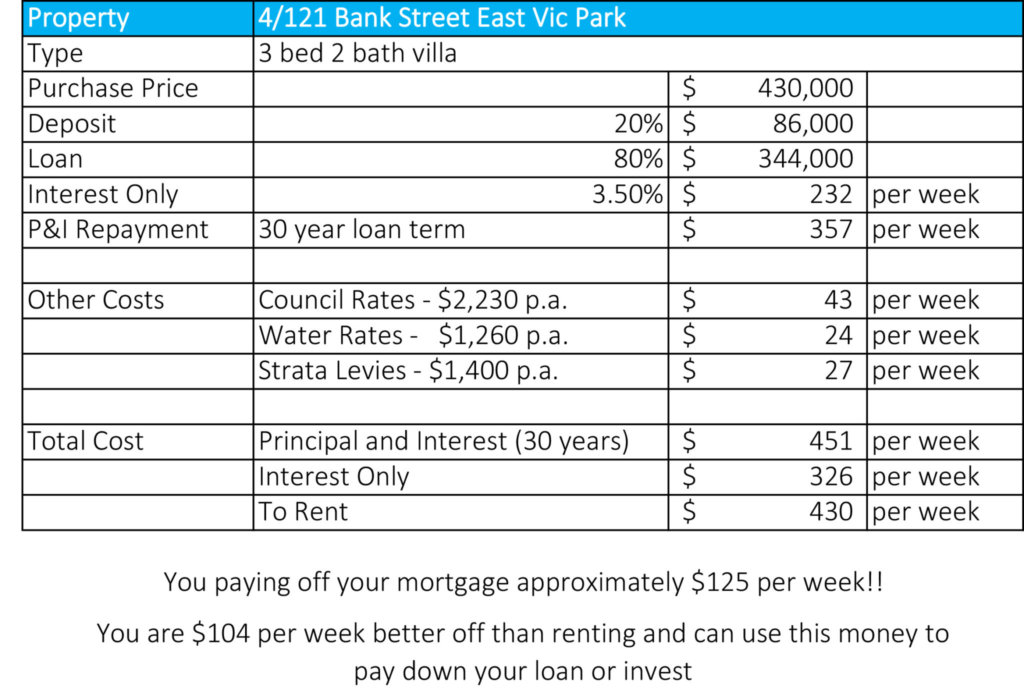

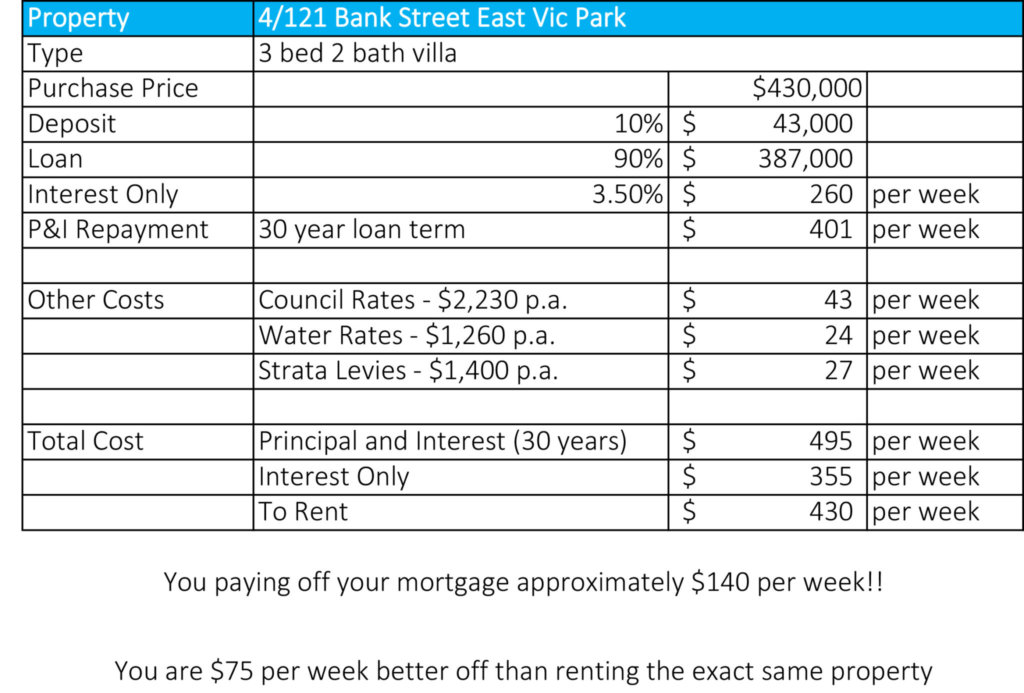

Well, I decided to have a look at the cost comparison between renting and buying in Perth in today’s current market, using a real example of a 3 bed, 2 bath villa we had been renting out at $430 per week. We have now put this villa on the market at $430,000 – having sold 8 of the other villas in the same complex.

In the below tables you can see that I have considered the following information:

- Purchase Price

- Size of deposit being either 10% or 20%

- A 5 year fixed interest rate of 3.5% (available to Owner Occupiers at just about every major bank)

- Actual council, water rates and strata levies

- Direct rental comparison

- Interest Only versus Principal and Interest

What I discovered is that right now tenants with a 10% deposit or more can go out and buy this villa and it would cost them less per annum than choosing to rent it.

Okay, so perhaps the total repayments will be marginally higher assuming principal as well as interest repayments, and a 30 year loan term but a significant portion of that repayment is going towards debt reduction. Just like savings in a bank account or investing in shares / super… this is not a cost, it is an investment! A most significant investment in paying your home off in 30 years or less.

In summary:

To rent the home: $430 per week

To buy the home on 20% deposit: $451 per week **

To buy the home on a 10% deposit: $495 per week **

** Includes principal and interest repayments, council and water rates and strata levies / building insurance.

At the end of the 5 year fixed interest rate period you will have paid the loan down by between $37,000 and $41,000.

How many tenants do you think will have between $37,000 and $41,000 sitting in their bank account in 5 years’ time?

If you have been a tenant for the last 5 years do you have money saved in the bank right now?

Interestingly, first home buyers often ask how big a deposit they should save before buying. In the above example you can see that getting into the market on a 10% deposit only adds $44 per week. So the real question would be is it worth getting in early on a 10% deposit or continuing to save?

I’d suggest talking with a reputable mortgage broker about all the numbers discussed above is crucial in making an informed decision and I would be happy to put you in touch with Donna-Lee Parkes at Celsius Finance for a no obligation chat.

I think it is just as critical to make an informed decision on the overall property market you are looking to enter. As I have often said there might be just as much risk sitting out of the market as there is being in it…

I look forward to updating the numbers in 6 months to see which way the pendulum is swinging, I have my view and would be happy to share with you anytime. Feel free to contact me on 0411 144 230 to review any property you may be considering purchasing.

All the best

Read our latest Celsius monthly newsletter here

Disclaimer: The data in this article has been put together for illustration purposes only and should not be relied upon when making a decision to invest in or purchase a property. Please consult with a qualified mortgage broker for detailed comparison rates and full cost analysis before making any decision.