2022 will undoubtedly bring many surprises

Perhaps by now nothing should come as a surprise and yet, week after week in the current environment something does.

I’d like to wish everyone a very happy New Year and yet I am conscious of the many families in Western Australia right now that have had their hopes of seeing loved ones temporarily dashed one more time. Let’s hope that through 2022 we can get through the worst of Covid-19 and once and for all come out the other side reconnecting with the rest of Australia and the world.

As we plan for 2022, we have made the conscious decision to focus on what we can control, whilst preparing for some disruption and chaos along the way. Presently, the motto at Celsius is ‘we are all in this together’ and we look forward to doing whatever we can to assist our valued Clients.

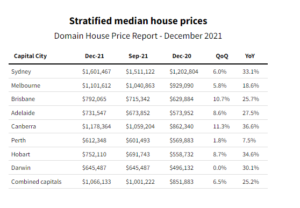

I must say when considering how well WA has performed through Covid with respect to the budget surplus, record low unemployment, huge job vacancies, record low rental vacancies and very little property available for sale, it surprises me that we remain the most affordable capital city in Australia and by some margin!

Source: Domain, powered by APM, combined capitals stratified median price series

Source: Domain, powered by APM, combined capitals stratified median price series

That being said, in the current climate, my preference certainly is for us to be the most affordable capital city rather than the least! Consider when the borders eventually do come down and migration takes hold. We have stacks of available jobs across multiple industries, affordable homes, a great climate and a clean city.

So where to for Perth property in 2022? REIWA has forecast continued capital growth through 2022 and given the lack of supply and expected population growth we agree. We also note that the performance is never uniform, varying from suburb to suburb and type of property. The electrifying growth seen in established homes in near city suburbs has left a significant gap between types of dwellings within these same suburbs and this gap will likely be pared back over the medium term.

In 2021 we saw record numbers of long term Perth Investors use the improved market conditions to quit their investment, often at not much better than break even or perhaps a loss. Whilst we spent much of 2021 counselling our Landlords against selling at this time, circumstances of many meant it was the right time to quit their investment. Interestingly the vast majority of these investment properties have been sold to Owner Occupiers, futher diminishing the number of rental properties on the market. At the same time the majority of new housing supply has been purchased by Owner Occupiers, further leaving Tenants wondering where they are meant to live and putting sustained pressure on rental values. Finally we are seeing Investor activity increase with a significant increase in Interstate Investors active in our market. What do they see in our market that perhaps our local Investors are yet to realise?

The forecast increase to the vacancy rate once the stimulus housing began to complete has not materialised to date and we believe this is for 2 reasons:

- Many of those homes have since been sold to Owner Occupiers taking them out of the rental pool;

- Many of these New Home Buyers were living in shared rentals so when one person moved out into their new home the other has either stayed or had to find a new rental home to live in.

We remain confident that the volume of people waiting to get into WA, as evidenced by the media reports of some 80,000 arrivals that had been due to arrive within 2 weeks of the borders opening, will more than compensate for any increased housing supply. In fact, we remain deeply concerned by the lack of supply coming online and the pricing pressure that may put on the market.

The job of our Development Team through 2022 is to bring a number of our built form and land estate developments to fruition whilst navigating the higher than anticipated construction costs and current significant labour and supply chain disruptions making it hard for Builders to complete jobs on time.

Managing the expectations of Buyers, Sellers, Tenants and Owners can always be challenging in times like these and we promise to communicate with our valued Clients as often as possible.

In closing, we feel confident that the housing market will continue to play catch up on the East Coast capital cities and those set in property will reap the benefits. If you are not yet set and wondering whether now might be a good time for you to join the property market or secure an investment property feel free to reach out to our team for an obligation free chat.

All the very best,