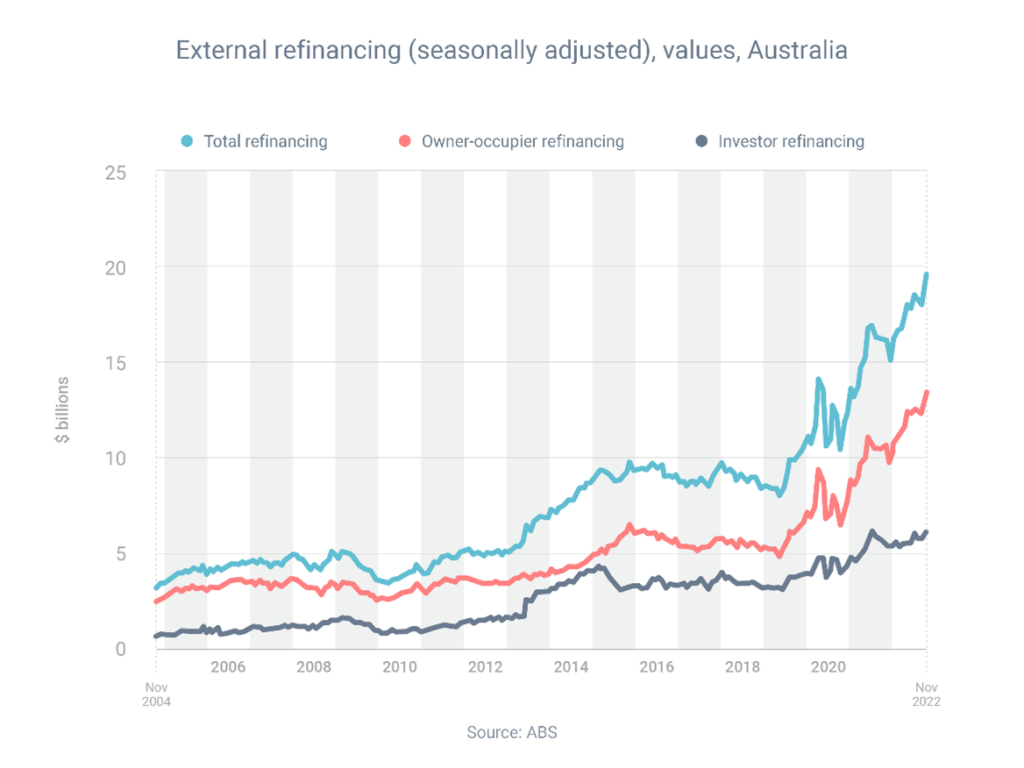

Borrowers refinance a record $19.5bn of home loans

Refinancing activity is at ultra-high levels right now, as owner-occupiers and investors alike try to find home loans with lower interest rates as the Reserve Bank continues to raise the cash rate.

Borrowers refinanced a record $19.5 billion of loans in November, the most recent month for which we have data, according to the Reserve Bank of Australia.

By way of comparison, that was 20.4% higher than the year before and 88.2% higher than two years before.

The Reserve Bank has hinted that at least one more rate rise is coming. In December, the Reserve Bank said it wanted to “return inflation to the 2-3% target range over time” (it’s currently 7.3%) and would “do what is necessary to achieve that outcome” – i.e. further increase the cash rate.

We have been in touch with most this month, but if you haven’t heard from us and it’s been a while since you took out your home loan, now would be a good time to think about refinancing or doing a health review.

Contact me to get the ball rolling. I’ll be happy to crunch the numbers for you, so you can see if refinancing would be suitable for you and how much money you could save by switching to a comparable lower-rate loan or at the very least achieve a lower rate with your existing lender.

Warm Regards,