Perth Property in 2023 sees property fundamentals take on consumer confidence

In the blink of an eye 2022 and the festive season break is well and truly over and we are full steam ahead into 2023. Without a doubt 2022 threw up many challenges that had not and perhaps could not have been planned for. Whilst we can’t change the past we can reflect on it, learn from it and adjust to improve into the future.

On the way to the office this morning I was listening to Trent Fleskens, The Perth Property Market podcast which is described as a podcast by WA experts for WA listeners. This week Trent hosts Brendon Ptolomey, the MD of Valuation Firm Herron Todd White. Remarkably in this weeks episode Trent starts by advising that his Perth Property Podcast now has more East Coast listeners than Perth listeners, this is quite remarkable given he has done absolutely no advertising of the podcast.

So what is it that east coast investors recognise in the Perth residential property market that Perth investors don’t yet?

Despite a record 8 cash rate increases in the second half of 2022 the Perth market remains in a fundamentally strong position. Increased construction costs have significantly constrained new supply and as population growth returns to pre-pandemic levels, this is resulting in a housing crisis that is likely to worsen in the next 12-18 months.

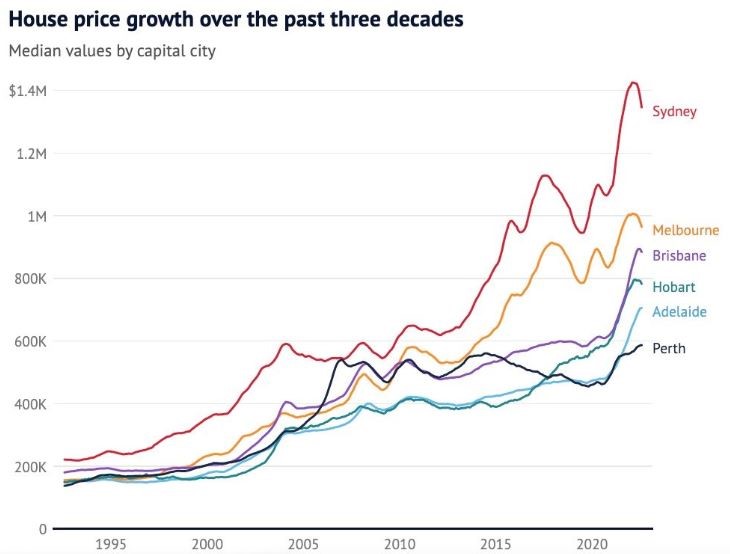

Perth’s median house price is currently sitting at $540,000 making it the most affordable capital city in the country. Demand for property remains high with the city recording an average of 911 transactions per week in 2022. This compares to 930/week in 2021, and is well above the 800/week recorded in the last boom period for the Perth market in 2007.

On the supply side, the market is significantly constrained. Current total properties on the market is sitting at 7,260. A balanced market in Perth is generally considered to have 12,000-13,000 properties on the market so we are approximately 40% below a balanced supply level.

The results of this imbalance are now playing out in the rental market which is reaching crisis point. Our vacancy rate is sitting at below 0.5% and the number of rental properties on the market is continuing to fall as mum and dad investors quit the market after a prolonged period of under performance. This stock is then generally being purchased by owner occupiers further worsening the rental shortfall. The number of available rental properties in Western Australia has reduced by over 18,000 since January 2021, according to DMIRS, who manage all residential bonds.

With construction costs increasing between 30-40% in the last two years, the market has been unable to provide new supply with no new major apartment projects commencing in Perth in the last quarter of 2022. The result of this halt in construction will be supply dropping of a cliff in 12-18 months. When combined with increased migration, this will ultimately underpin continued growth in the Perth market which is coming off a much lower base than the rest of the country.

So the question for 2023 is, will the dent in consumer confidence prevent Buyers taking action after 8 consecutive interest rate rises, or will the very strong fundamentals including historically still very low interest rate settings see a buoyant market? Perhaps Trent’s closing comment ….

Perhaps as suggested by Trent, if you are on the fence get out there and buy a property!

Whether you are a first home buyer, upgrader, downsizer or investor our team is ready to assist you with any queries you may have to allow you to make an informed decision.

All the very best,